Course Program of Study

Course Program of Study (CPoS) is a federal/state requirement that only allows courses that count toward a student's program of study (your declared major) to be considered when determining federal/state financial aid eligibility. There's a lot to learn about CPoS, so we've created this page to educate Tech students on Course Program of Study and how it may affect their financial aid eligibility. Click the links below to learn more!

What to Know Check Your CPoS The Federal Repeat Rule Frequently Asked Questions

What to Know About CPoS:

Course Program of Study, or CPoS, is a federal mandate that states that for students to utilize their awarded federal and state aid to help cover their course costs, the courses they register for must count towards their Program of Study, aka a student’s declared major/degree path. Therefore, received federal and state aid will not pay towards courses that do not count towards a student’s major.

Aid that falls under the CPoS rule includes but is not entirely limited to: Federal PELL Grants, Federal Student Loans, Parent PLUS Loans, and state aid including the HOPE Scholarship. In general, institutional scholarships awarded by Tech and external scholarships are excluded from the CPoS requirement. Please read the information posted below for more information concerning CPoS and the registration requirements students must meet to use their awarded/offered federal and state aid.

-

-

Undergraduate students must register for at least six credit hours [courses that count towards their program of study] per semester to utilize their federal or state aid they have received for any given term. The exception to this rule is the Federal Pell Grant, which will post even if a student registers for less than six credit hours. Students do not have to register for 12 credit hours per semester for their aid to pay towards their costs - however, please note that a student’s federal and state aid will adjust to match their credit hour status. For example, a student who has received a Federal PELL for an aid year will receive their full semester amount if they are registered for 12 credit hours, but if a student registers for only 9 credit hours, they’ll receive a reduced amount of their PELL funds to help cover their semester costs because they are not considered full time. The HOPE Scholarship adjusts to match a student's status as well - read more on our HOPE Scholarship Eligibility page.

-

Graduates must register for at least five credit hours for their federal loans to post.

-

Barring certain exceptions, courses required for a minor are not covered by federal and state aid. This means that minor hours are not counted as credit hours in the system. For example, if a student has registered for 12 hours for Fall, but one of the 3-hour courses they registered for is a minor course, the system marks that the student is only registered for 9 credit hours, or hours that count towards their degree. The aid they receive for that semester will only pay out to cover those 9 credit hours, and not the 3-hour minor course.

-

To learn more about Course Program of Study, make sure to check out the FAQs section below!

The Federal Repeat Rule & CPoS

A student's ability to use their federal and state aid to help cover courses in their program of study can be affected if a student exceeds the number of course repeat attempts allowed for federal aid.

The Federal Repeat Rule stipulates that if a student receives an 'F' grade in a course, they are permitted to retake the course with federal/state aid as many times as they need until they receive a 'D' grade or higher. Once a student receives a 'D' or higher in course, that student is only permitted to use their federal/state aid to pay for that course one additional time after that. This is regardless of what grade they receive or the grade required for progression in their major.

In short, if you received a 'D' grade in one of your courses, you are only eligible

to use your federal/state aid to cover that course ONE more time, even if the course is required for your major. After that final attempt,

and if you receive a letter grade for the course, the course will no longer count towards your CPoS in the system, and your federal/state

aid will not cover the costs of that course moving forward.

Please read the below scenarios for more information regarding the Federal Repeat Rule. If you have questions, please contact the Office of Financial Aid for assistance!

If you have additional questions about the Federal Repeat Rule and how it affects your aiod eligibility, please contact the Office of Financial Aid for assistance!

Frequently Asked Questions (FAQs)

Below you'll find the most common questions we hear from students concerning how Course Program of Study requirements affects their aid. Simply click on the desired question for the answer!

Remember, if you have specific questions about courses in your program of study, please contact your advisor!

- » What is Course Program of Study (CPoS)?

- » When did CPoS become a requirement?

- » Why should I be aware of CPoS?

- » What type of aid does CPoS impact?

- » Does CPoS affect my Tennessee Tech awarded Scholarships and grants?

- » For the upcoming semester, I plan to enroll in 17 hours - 3 of those hours does not count towards my program of study. Will financial aid pay for the ineligible 3 hour class since I am above full-time?

- » I want to use my federal student loan offers to help pay my costs, but only 4 of my 9 enrolled hours apply towards my current degree path. Can I still use those loans?

- » How and when will I know if I am impacted by CPoS?

- » One or more of my courses doesn’t count in my program. What should I do?

- » An academic advisor has determined one or more of my courses are not required for my program of study. What can I do?

- » Can I appeal a determination that a course does not apply toward my program of study?

- » An advisor has submitted a course substitution form. When will my financial aid be updated to reflect this request?

- » My advisor submitted a course substitution form for one of my courses that was not counting towards my degree in the system, and the substitution was processed and my degree path updated. When will I know if the changes 'fixed' the issue?

- » I am enrolled in courses that aren't part of my program of study but that I am interested in. Will CPoS impact me?

- » When is the last day to make major changes or modify my enrollment to potentially impact CPoS?

- » Do electives count toward CPoS?

- » How are courses needed for completion of minors treated?

- » How are courses needed for double majors treated?

- » How does CPoS affect study abroad?

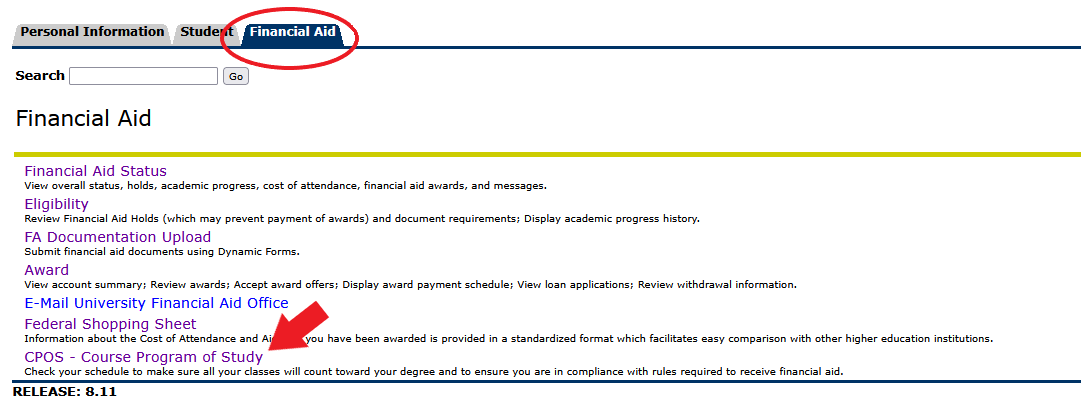

Log-in to Eagle Online and select Financial Aid - CPOS Course Program of Study

Log-in to Eagle Online and select Financial Aid - CPOS Course Program of Study

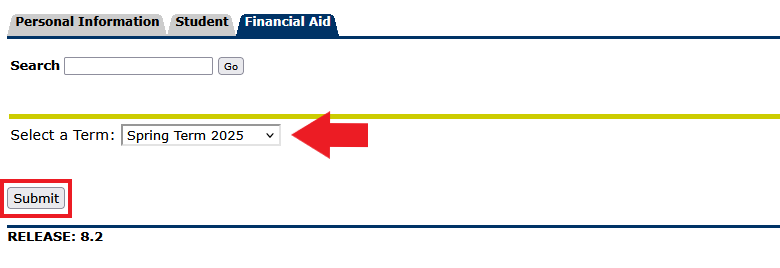

Select the correct term and click Submit

Select the correct term and click Submit

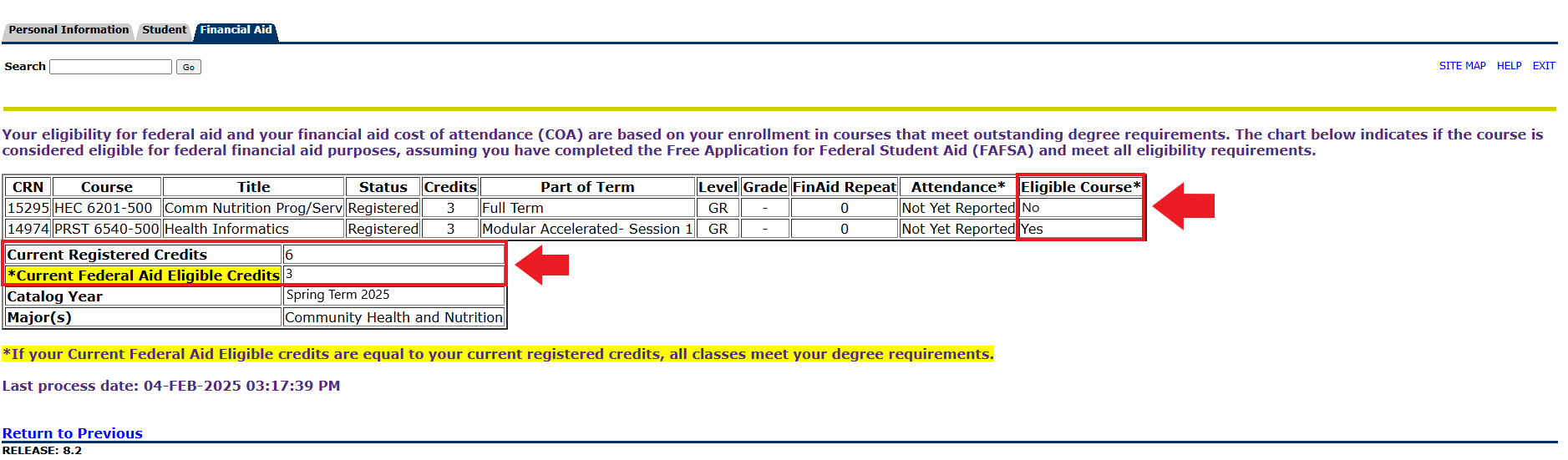

Check your courses to confirm they count towards your CPoS

Check your courses to confirm they count towards your CPoS